Hi. My name is David and I'm a Citigroup addict. My addiction started in 1990

Hi. My name is David and I'm a Citigroup addict. My addiction started in 1990

when I took out a student loan to get a root canal. I had been financing a significant portion of my graduate school expenses using a Citibank credit card and paying 19.8%. The root canal didn't cost as much as I thought so I did something I would never do now, I bought a long term position in a stock on borrowed money. To avoid brokerage fees and get a discount on the stock, I sent a check to Citi's Dividend Reinvestment Plan (DRIP). I still own those shares. Later when I had a job I sent a monthly check and accumulated more with my megre savings until Citicorp (that's what it was called back then) cancelled their DRIP and dividend in the early 1990's. I have never sold a share of Citigroup. My position in the stock has enjoyed significant capital gains and I already have a big exposure to financials through my holdings in previous employers.

On Friday, I paid $50.10 for more Citigroup (C). I couldn't help myself. It just happened. The stock was down a few percent, I saw that p/e of 11.5, a dividend yield of 4.4%, a growing global business with a presence in every market of the world. I saw that I was getting investment banking talent at a commercial bank price with a great franchise thrown in. I just had to buy.

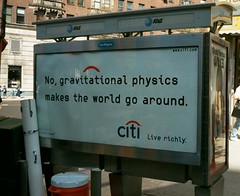

Disclosures and Confessions: I own Citigroup(C). I used Citibank global banking services while living abroad. I found the Citibank Live Richly campaign fantastic. Even though I thought Citigroup a bit insincere, I hope the anti-greed messages stuck with some people.

Disclaimer: Nothing in this trade log is meant to be specific financial advice or a recommendation to buy or sell. I do not give investment advice. Do your own research. Do not rely on anything in this weblog to make investment decisions. I do not log all my trades here. I only describe or mention those that I think might be interesting. Consult an investment professional familiar with your specific financial situation before buying or selling any security. Options may be for me but they are are not for everyone. Futures are highly speculative. You can lose more than your initial investment in futures.

Photo Courtesy of A.M. Kuchling via Flickr and Creative Commons